Bank Teller Resume Example

Use a bank teller resume example to build a professional profile

- Experienced Bank Teller Resume Example

- Entry-Level Bank Teller Resume Example

- Typical Responsibilities Bank Tellers Are Tasked With

- Different Bank Teller Skills to Boost Your Profile

- Transferable Skills for Entry-Level Bank Tellers

- Additional Resume Sections Bank Tellers Should Have

- Average Bank Teller Salary

- Most Common Banks to Find Work as a Bank Teller

- Key Points

If you’re a Bank Teller on the hunt for your next job, it’s essential to understand just how important a well-crafted resume is.

You need to tailor your application to the Bank Teller role, which can sometimes be easier said than done. After all, you must ensure you can grab a hiring manager’s attention and prove that you can handle all the responsibilities.

If your resume is getting overlooked, we’ll help you go the extra mile and create a tailored resume that will earn additional points with a hiring manager. We’ll explain:

- What Bank Teller duties to focus on to impress a hiring manager

- Skills specific to Bank Tellers that you should list and how

- What salary you should expect when starting your new job

If you’re able to touch on these topics in your application, you’ll have a good chance of securing more interviews than ever.

Also, it never hurts to use some tools. Use our convenient resume builder to make the task even simpler.

Find out what you need to do below to make your resume stand out.

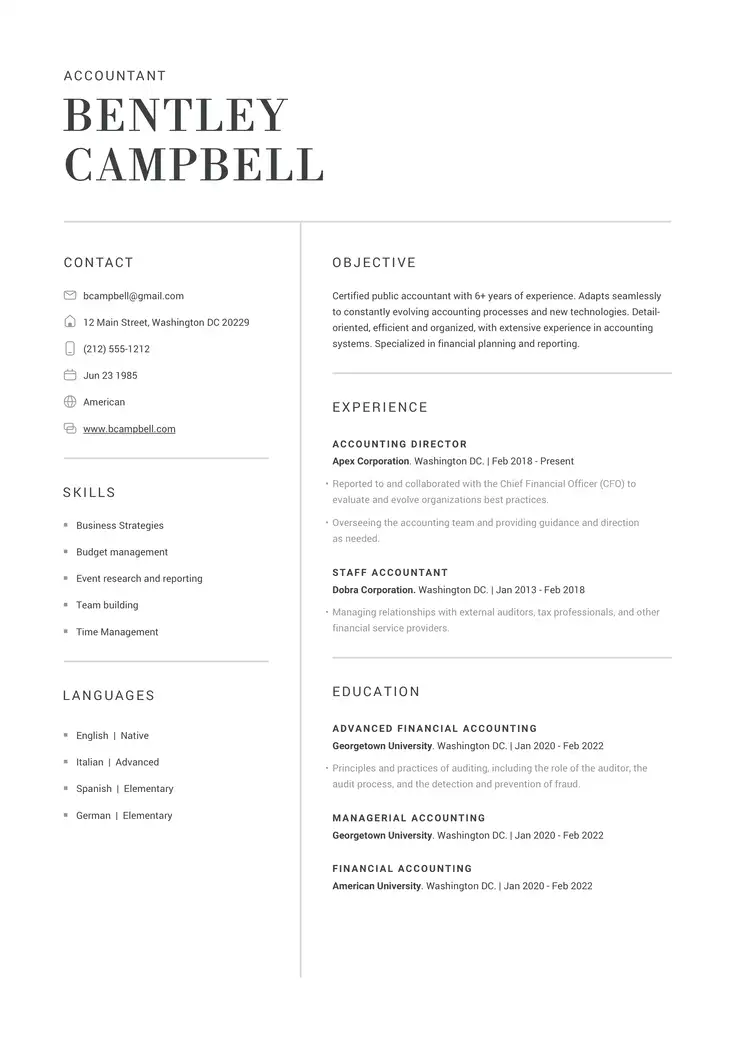

Experienced Bank Teller Resume Example

Are you trying to envision your application completed and ready to go, but just coming up with a blank page?

The best thing for you to do in that case is to take a look at our resume example below.

It demonstrates how you can display your skills and experience, and get a better understanding of what data to include to show how capable you are.

John Doe

Bank Teller

123 Finance Way, Springfield, IL 11111

Phone: (555) 123-4567

Email: john.doe@randomemail.com

LinkedIn: www.linkedin.com/xxxxx

Personal Statement

Experienced Bank Teller with over 6 years in the banking industry, having successfully processed over 10,000 transactions. Specialized in accurate and efficient handling of cash, checks, and account services. Contributed to a 99% customer satisfaction rate in my current role. With an extensive knowledge of banking regulations and fraud detection.

Experience

Lead Bank Teller, First National Bank – Springfield, IL | June 2019 – Present

- Managed a team of 5 bank tellers, ensuring best practices and quality customer care.

- Organized monthly training sessions on fraud detection, leading to a 20% decrease in fraudulent activities.

- Implemented a new system for handling customer complaints, increasing customer satisfaction by 15%.

Senior Bank Teller, City Bank – Springfield, IL | June 2017 – June 2019

- Processed over 50 transactions daily, maintaining a 99% accuracy rate.

- Assisted in the development of new protocols for cross-selling bank products, resulting in a 10% increase in sales.

Education

B.S. in Finance | Springfield University | 2017

Skills

- Cash Handling and Management

- Customer Service

- Cross-Selling Banking Products

- Fraud Detection

- Account Services

- Attention to Detail

Awards & Honors

- First National Bank “Employee of the Month” – July 2019

Languages

- English: Fluent (Native)

- Spanish: Fluent

Entry-Level Bank Teller Resume Example

If you’re an entry-level bank teller you may be worried your lack of experience will hurt your chances of landing the job.

Luckily, there are ways around this, like using a functional resume format that places importance on skills and motivation to improve rather than experience like in the example below.

Anna B. Thompson

Bank Teller

456 Finance Street, Charlotte, NC 22222

Phone: (555) 987-6543

Email: anna.thompson@randomemail.com

LinkedIn: www.linkedin.com/xxxxx

Personal Statement

Recent graduate in Finance with certified training in banking operations. During my internship at City Bank, I conducted over 200 supervised transactions. Proficient in basic cash handling techniques and keen on kick-starting my banking career at a top-tier financial institution, bringing efficiency and dedication to customer care.

Skills

- Cash Handling

- Customer Service

- Basic Banking Operations

- Data entry

- Adaptability

- Computer literacy

- Multitasking

Education

B.S. in Finance | Charlotte University | 2022

Certifications

- Certified Bank Teller (CBT) – American Bankers Association

- Anti-Money Laundering (AML) Certification

Internships

Bank Teller Intern, City Bank – Charlotte, NC | January 2023 – May 2023

- Gained hands-on experience in processing transactions under supervision.

- Maintained records of over 30 customers daily.

- Learned techniques for identifying and preventing fraudulent activities.

- Demonstrate Your Knowledge of Banking Regulations

Languages

- English: Fluent (Native)

- Chinese: Fluent

- Spanish: Intermediate

Typical Responsibilities Bank Tellers Are Tasked With

An employer or an ATS will quickly scan your resume to see if you are a candidate worth calling in for an interview.

To impress a hiring manager, you’ll need to prove that you can successfully carry out all the duties of a Bank Teller.

A hiring manager will want to see that you performed some of the following tasks in your previous position:

- Assist with accountant services

- Handling of high-volume transactions

- Managing the cash drawer

- Transaction processing

- Cross-selling

- Record keeping

- Check cashing

- Fraud detection

- Ordering cash

- Currency exchange

However, it’s not enough to simply list them. Mention how well you did the tasks with quantifiable data, like in the example of a Bank Teller resume experience section below:

Bank Teller, City Bank – Charlotte, NC | January 2020 – December 2022

- Processed over 100 transactions daily including deposits, withdrawals, and bill payments, maintaining a 99% accuracy rate and contributing to the branch’s reputation for efficiency.

- Assisted an average of 50 customers per day, resolving inquiries and providing information about bank products and services, which contributed to a 10% increase in cross-selling success rate.

- Identified and prevented an average of 3 fraudulent activities per week by meticulously verifying customer identity, examining documents for forgery, and adhering to the bank’s security protocols.

Bank Teller Resume Power Words

To describe your experience, motivation, and other information about your professional qualifications, you’ll need to use the right vocabulary or power verbs.

Using this type of vocabulary will help you avoid bland text throughout your resume.

Here is a list of words you can use in your experience section or even personal statement:

- Processed

- Assisted

- Verified

- Promoted

- Compiled

- Cross-sold

- Detected

Keep these words in mind when describing your previous duties as a Bank Teller.

Different Bank Teller Skills to Boost Your Profile

As a Bank Teller, you’ll have different jobs, which means you’ll need various skills to complete your tasks.

These skills should be related to working as a Bank Teller.

Throughout your resume, such as in the skills section you can add any of the following that best applies to your abilities:

- Banking software proficiency

- Financial product knowledge

- Currency exchange knowledge

- Regulatory compliance awareness

- Advanced mathematics knowledge

Examine the following sample of a resume summary to see how these skills can fit.

Experienced Bank Teller of 5 years with a strong track record of efficient transaction processing and excellent customer service. Proficient in banking software and knowledgeable in the bank’s financial products. Eager to leverage these skills to enhance customer satisfaction and drive sales.

Transferable Skills for Entry-Level Bank Tellers

Are you looking to apply for an entry-level Bank Teller position? If this is your first time applying for a full-time position there are some skills you should include that you’ve picked up being employed in another field.

Here’s an idea of some transferable skills you could add to your resume:

- Customer service

- Data entry

- Adaptability

- Computer literacy

- Multitasking

- Problem-solving

- Mathematical skills

While these aren’t exclusive to a Bank Teller position, they can still impress any hiring manager at a bank.

In this case, it’s also a good idea to write an objective statement that includes these skills, such as:

Energetic and detail-oriented individual with strong mathematical skills and a proven track record in delivering excellent customer service in fast-paced environments. Adept at problem-solving and eager to bring my transferable skills to a dynamic bank teller position.

Additional Resume Sections Bank Tellers Should Have

Let’s say you want to take your resume another step further. There are some extra Bank Teller resume sections that you can add to impress a hiring manager even more.

Adding “other” sections can help you big time if you have any certifications or extra knowledge that make you an excellent Bank Teller.

Some examples of additional sections include:

- Certifications: Adding a certification to your resume shows that you’ve developed your skills and can handle more advanced responsibilities.

Certifications

Certified Anti-Money Laundering Specialist (CAMS) | July 2022

- Issuing Organization: Association of Certified Anti-Money Laundering Specialists (ACAMS)

- Languages: Being a Bank Teller means you will likely need to speak with someone who doesn’t know English that well and employers know it. If you speak another language add it to your resume.

Languages

- English: Fluent (Native)

- Chinese: Fluent

- French: Intermediate

Showing off isn’t a bad thing, but try not to add too many extra sections to your resume, 1 or 2 should be enough.

Average Bank Teller Salary

Before you go in for an interview, it’s a good idea to understand what to expect to be paid as a Bank Teller. The median salary for a Bank Teller in the United States was around $36,800.

However, this can change depending on the amount of experience you have and where you live.

The industries for Bank Tellers that earn the highest salaries are:

- Securities, commodities, contracts, and other financial investments: $40,250

- Management of companies and enterprises: $36,430

- Credit intermediation: $36,800

- Nondepository credit intermediation: $34,410

With this knowledge, you can negotiate a price and avoid getting lowballed.

Most Common Banks to Find Work as a Bank Teller

Whether you live in the big city or a small town you shouldn’t have trouble finding a bank or 2 in your area.

However, while you likely know the names of all the typical banks around the United States, you might not know which ones employ the most Bank Tellers.

According to Glassdoor, these banks offer the most Teller jobs:

- Well Fargo

- Chase

- Bank of America

- TD

- PNC

You can check to see if one of these banks is hiring in your area and send your updated resume in right away.

Key Points

To make your resume and application look like a million bucks it’s’ so important to add details specifically related to being a Bank Teller.

You don’t want to bore a hiring manager with too much detail, but you need to add quantifiable data and all the action words that will grab their attention.

By doing so, you’ll have a resume with relevant skills and sections many other candidates probably won’t have on their application.

To ensure your resume is on the money, remember to:

- Use the correct structure and format for your resume

- Address your past responsibilities in your experience section with power verbs and adjectives

- Highlight your most relevant skills

- Include transferable skills if you’re a first time Bank Teller candidate

- Add an extra section, for example, your language proficiency or certificates

Use our advice and organized templates to give yourself a better chance than ever before of landing a Bank Teller role.

Related Professions